Türkiye is expected to be the main driver of regional economic expansion in the coming years, the World Bank said, as it raised its 2025 growth forecast for the country to 3.5% from 3.1%, citing sustained demand and employment, according to its latest Europe and Central Asia Economic Update.

The bank also projects the Turkish economy to grow by 3.7% in 2026 and 4.4% in 2027. The revision stressed Türkiye’s central role in supporting regional demand, with the World Bank noting that despite slowing global growth, the broader Europe and Central Asia (ECA) region has remained resilient.

The World Bank expected overall growth in the ECA region to slow to 2.4% in 2025, down from 3.7% a year earlier, largely due to weaker output in Russia. Türkiye’s upgraded forecast contrasts with this slowdown, positioning the country ahead of the regional average.

According to the report, private consumption continues to be the main driver of growth in the ECA region, although its pace is moderating as real wage gains ease and job creation slows. In Türkiye, however, strong credit growth is helping sustain household demand. The World Bank highlighted that credit expansion has accelerated in 2025, with consumer borrowing rising at its fastest pace since late 2023 as the use of credit cards surged.

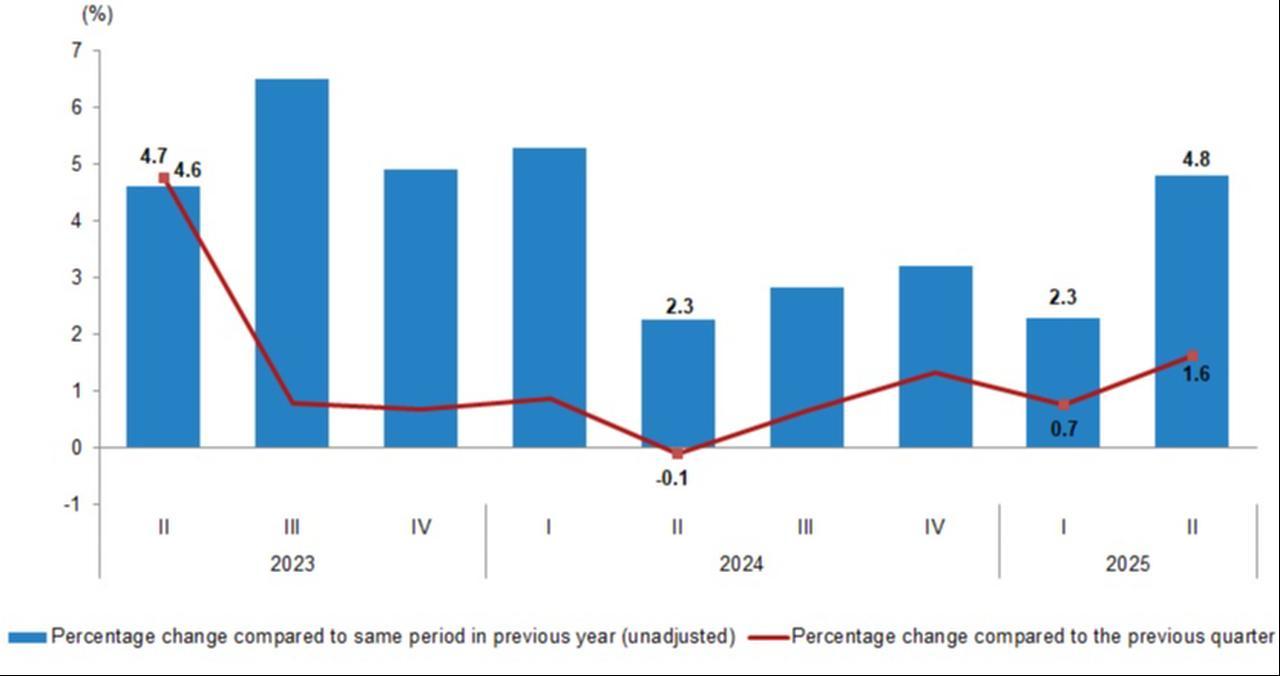

In the second quarter of 2025, Türkiye’s economy grew by 4.8%, driven primarily by household consumption and goods imports.

Alongside Central Asia, the South Caucasus, and the Western Balkans, Türkiye stands out as one of the economies where bank lending has supported consumer spending and softened the impact of global headwinds.

The report added that investment is beginning to rebound in Türkiye, particularly in construction, backed by state-led infrastructure and urban renewal programs as well as solid housing demand.

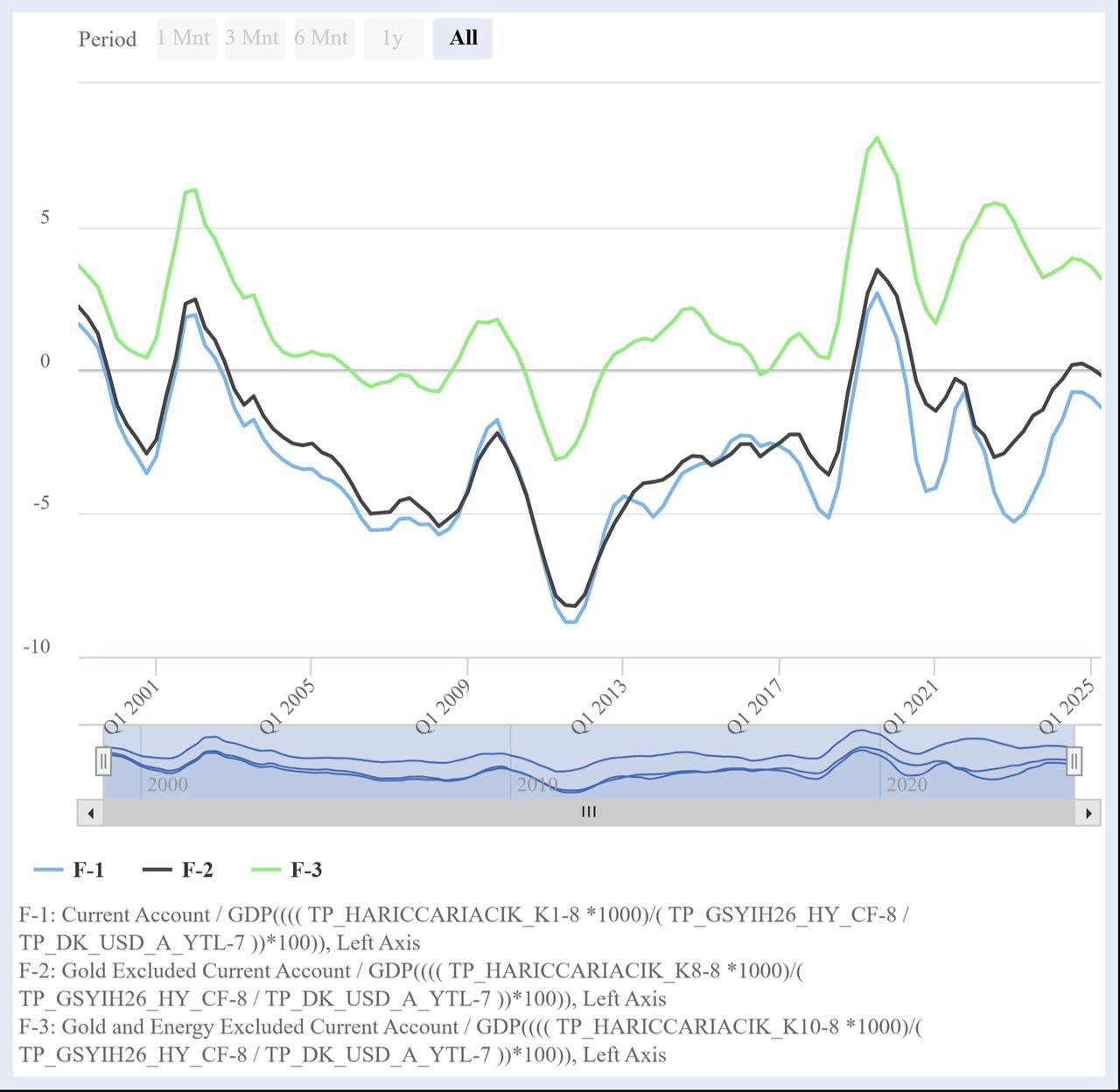

At the same time, the external position has weakened. Excluding gold, the current account deficit widened sharply in the first half of 2025, widening to 1% of projected gross domestic product (GDP), largely because of increased imports of consumer goods and energy. For the full year, the gap is expected to rise further to 1.2% of GDP, up from 0.7% in 2024.

Despite healthier revenue collection, the budget deficit is projected to stay above 4% of GDP in 2025. Debt servicing costs are weighing heavily on public finances, with interest payments more than doubling in the first half of the year to over 15% of central government expenditure.

The World Bank observed that higher labor force participation has helped boost employment across the Europe and Central Asia region, with the effect particularly visible in Türkiye and the Western Balkans. It pointed out that, unlike in other parts of the region, both Türkiye and Central Asia are likely to see a considerable rise in their working-age populations, which will require the creation of more jobs to absorb the additional labor supply.

The report outlined several areas where Türkiye could sustain growth and expand employment. These include tradable services such as logistics, manufacturing integrated into global value chains, renewable energy, and care-related sectors that can raise women’s participation in the workforce. The analysis also highlighted the potential for digital and ICT-based services to strengthen the country’s competitiveness.

Historically, industries such as accommodation, food services, retail, wholesale, logistics, and professional services have been major job creators in Türkiye. Tourism continues to underpin service-sector employment, while the logistics industry benefits from the country’s strategic location and manufacturing base.

Export-oriented manufacturing in fields such as automotive, machinery, metals, and electronics has also driven strong job growth among internationally connected firms. At the same time, the World Bank cautioned that challenges remain, including limited access to long-term financing, slowing productivity, skills mismatches, informality in the labor market, and barriers that restrict women’s full participation in employment.

On the global side, the World Bank projects U.S. growth at 2.3% in 2025, moderating from recent years as tight monetary conditions and slower consumer spending weigh on the economy. The euro area is expected to expand by 1.5% in 2025, with weak industrial activity and high energy costs continuing to pressure households and businesses.

China’s economy is forecast to grow by 4.8% in 2025, down slightly from 2024, before easing further to 4.2% in 2026. The slowdown is linked to weaker property investment and demographic pressures, though the country remains one of the largest contributors to global growth.