This article was originally written for Türkiye Today’s weekly economy newsletter, Turkish Economy in Brief, in its Jan. 26 issue. Please make sure you are subscribed to the newsletter by clicking here.

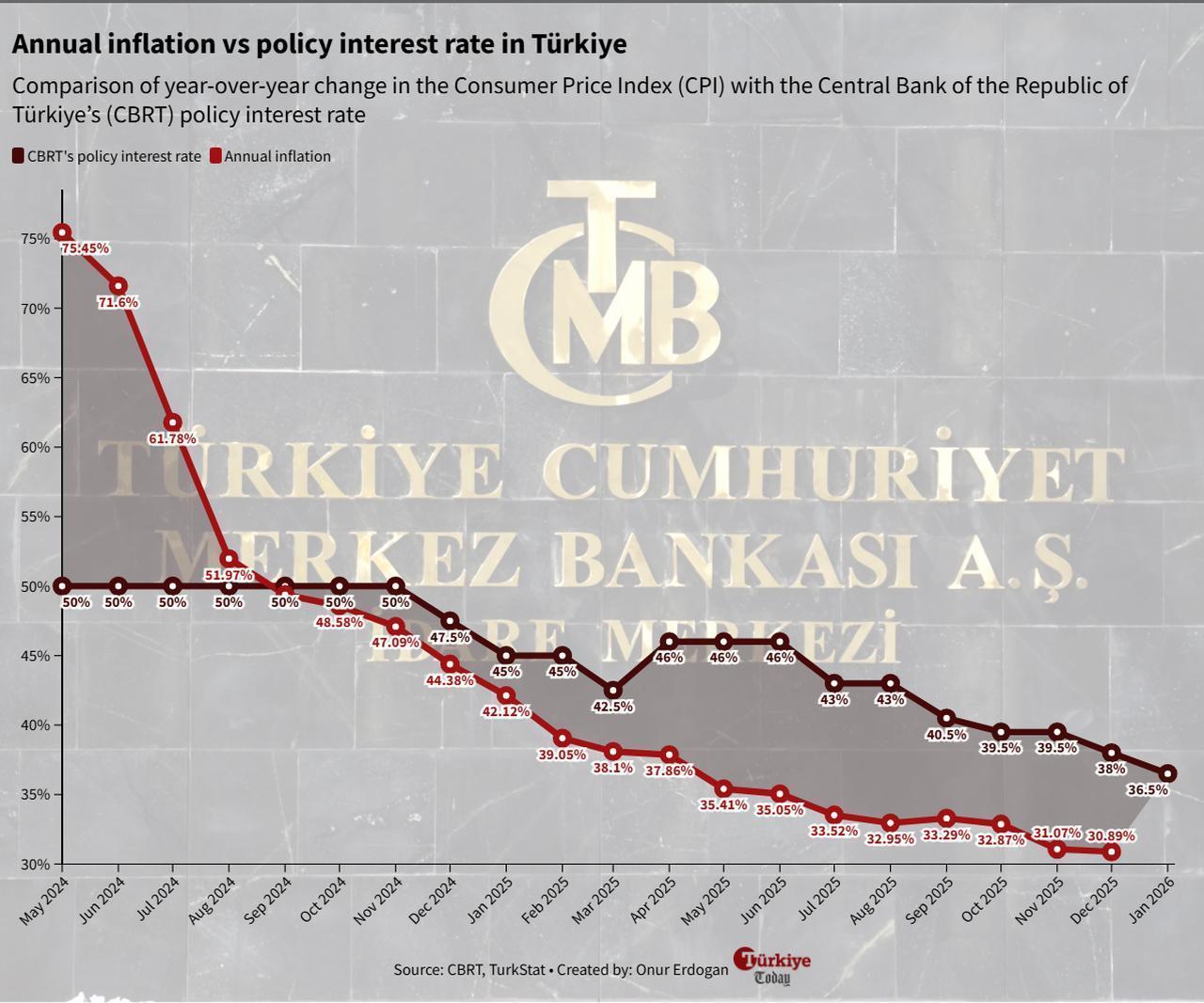

One of the most closely watched decisions in Türkiye’s financial markets was announced last week: the first interest-rate decision of the year. The Monetary Policy Committee (MPC) of the Central Bank of the Republic of Türkiye (CBRT), which convened on Jan. 22, opted for a 100-basis-point rate cut, bringing the policy rate down to 37%.

Markets had largely priced in a 150-basis-point cut, so the central bank’s move came in below expectations.

Following the "measured" rate decision, the CBRT stated that preliminary inflation data showed an increase in January, mainly due to food prices, while the underlying trend had risen only moderately.

Adopting a more cautious stance than markets anticipated, the CBRT said in its policy note: “Indicators for the last quarter point to demand conditions that continue to support the disinflation process, albeit at a moderating pace. While showing signs of improvement, inflation expectations and pricing behavior continue to pose risks to the disinflation process.”

After the central bank once again flagged inflationary risks, initial reactions from the markets indicate that January and February’s Consumer Price Index (CPI) figures will be critical in shaping the near-term monetary path.

In a note by local brokerage Alnus Investment, it was emphasized that inflation data from the first two months of 2026 would be pivotal for the next policy meeting scheduled for March 12: “If we see a figure around 3.75% for January, annual CPI could fall to around 29.20%. A February print below 2.27% could pave the way for another 100–150 basis point cut in March. However, higher-than-expected figures may weaken the CBRT’s hand.”

A report by another local brokerage, Gedik Investment, also assessed the decision, stating:

“We believe the primary motivation behind this move was not January’s high inflation, but the CBRT’s commitment to staying below the upper band of its 2026 year-end CPI forecast at 19%.”

The report further noted that this rate cut was perceived as a strong signal that the interim inflation target of 16%, to be highlighted in the Inflation Report on Feb. 12, would remain unchanged: “In this regard, the rate decision initially triggered a negative reaction in equities, especially banking stocks. However, given the CBRT’s stronger message of commitment to its inflation target, this reaction may prove temporary.”

The report also emphasized that January and February inflation figures—alongside developments in foreign exchange reserves—would be key ahead of the March meeting: “If January CPI comes in around 4.0% and February at 2.0%, in line with market expectations, the CBRT may continue with 100–150 basis point cuts. But a surprise to the upside in inflation data could reinforce the perception that rate cuts may be paused.”

Analysts of local lender Yapi Kredi also recalled CBRT Governor Fatih Karahan’s remarks that “disinflation may slow down in the first two months of the new year,” adding: “We view the short-term market impact of the decision as ‘mildly negative.’ In the medium term, however, we are optimistic.

We believe recent strong appetite for equities—especially in banking—will balance out somewhat. Likewise, the short end of the bond yield curve may see some profit-taking. We see these as part of a normalization in optimistic pricing. Looking further ahead, we believe sustained disinflation will continue to attract interest in local assets.”

In conclusion, it seems the markets will wait to see the January CPI print before reassessing the broader outlook and adjusting pricing accordingly.