The International Monetary Fund (IMF) urged Türkiye to accelerate structural reforms and maintain tight macroeconomic policies to secure lasting price stability, despite progress in lowering inflation and stabilizing the economy.

In a statement released Saturday following its 2025 Article IV consultation, the IMF Executive Board said authorities had made progress in reducing macroeconomic imbalances, restoring confidence and maintaining economic growth.

However, inflation remained above target, and the economy continued to face external vulnerabilities, it said, highlighting the need for tighter policies and further structural reforms.

The board called for measures to broaden the tax base, strengthen tax compliance and gradually phase out energy subsidies, for which the Turkish government is expected to allocate ₺383.5 billion ($8.79 billion) in 2026, saying these steps would reinforce fiscal discipline and support disinflation.

Directors also stressed the importance of aligning wage policies with inflation targets and enhancing oversight of public-private partnerships and state-owned enterprises.

"As fiscal space expands, additional resources could be redirected to social priorities," the IMF said, while urging authorities to carefully sequence policy changes to limit inflation spillovers and protect vulnerable households.

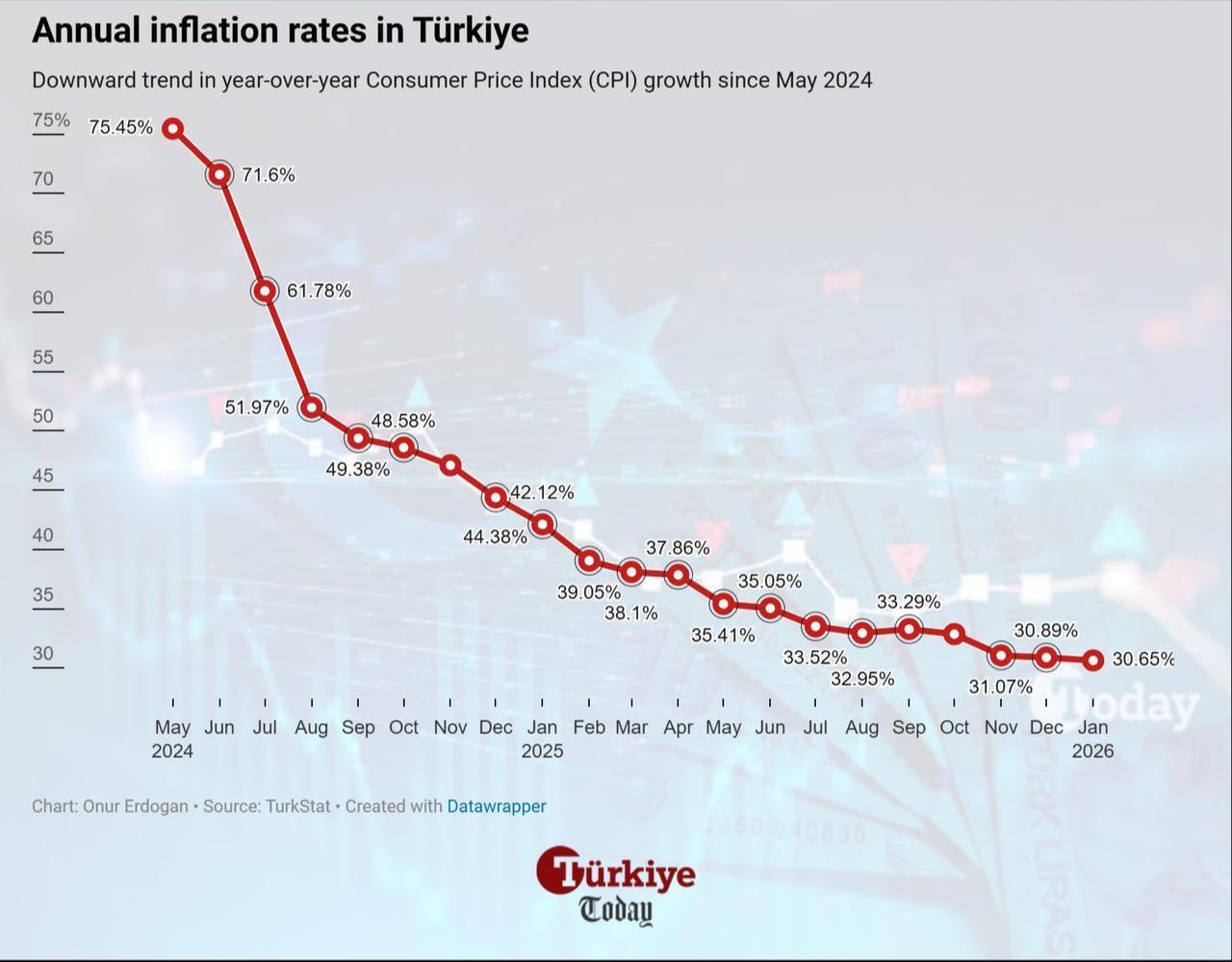

The IMF said Türkiye’s disinflation program had begun delivering results, with annual inflation declining from 49.4% in September 2024 to 30.9% in December 2025, driven by tight monetary policy, fiscal consolidation and restrained income policies.

The fund said the current policy mix "continues to balance disinflation with steady growth," noting that economic activity remained resilient despite tighter financial conditions.

GDP growth was projected at 4.1% in 2025, reflecting sustained domestic demand and improved confidence. The IMF also said stronger demand for the Turkish lira helped rebuild international reserves, while the current account deficit remained adequately financed.

The IMF projected inflation to fall further to 23% by the end of 2026, supported by continued tight monetary policy, moderate wage increases and a neutral fiscal stance.

Economic growth was expected to edge up to 4.2% next year as policy credibility improves and confidence strengthens.

At the same time, the fund warned that risks remained elevated due to global trade uncertainty and regional conflicts. It said external shocks, such as higher energy prices or adverse weather conditions, could prolong the disinflation process.

The IMF also noted that the gradual pace of inflation reduction had weighed on financial sector performance and slowed productivity growth.

IMF projections indicated Türkiye’s economy would expand by 4.1% in 2027 and maintain average annual growth of around 4% between 2028 and 2031.

Inflation was expected to fall to 19% in 2027 and decline further to 15% through 2031, while the current account deficit was forecast to remain contained at around 1.4% to 1.5% of GDP over the same period.