U.S.-based investment bank Morgan Stanley has forecast that the Central Bank of the Republic of Türkiye (CBRT) will reduce its policy rate by 100 basis points in December 2025, bringing it down to 38.5%.

The central bank is also expected to continue its easing cycle through 2026, lowering the policy rate to 27% by the end of that year and to 21% in 2027, according to the report by the U.S. lender.

The report, written by the bank analysts Georgi Deyanov and Andrea Masia, stated that the Turkish central bank is likely to increase the pace of cuts to 150 basis points per meeting in early 2026, before slowing the pace again to 100 basis points by year-end.

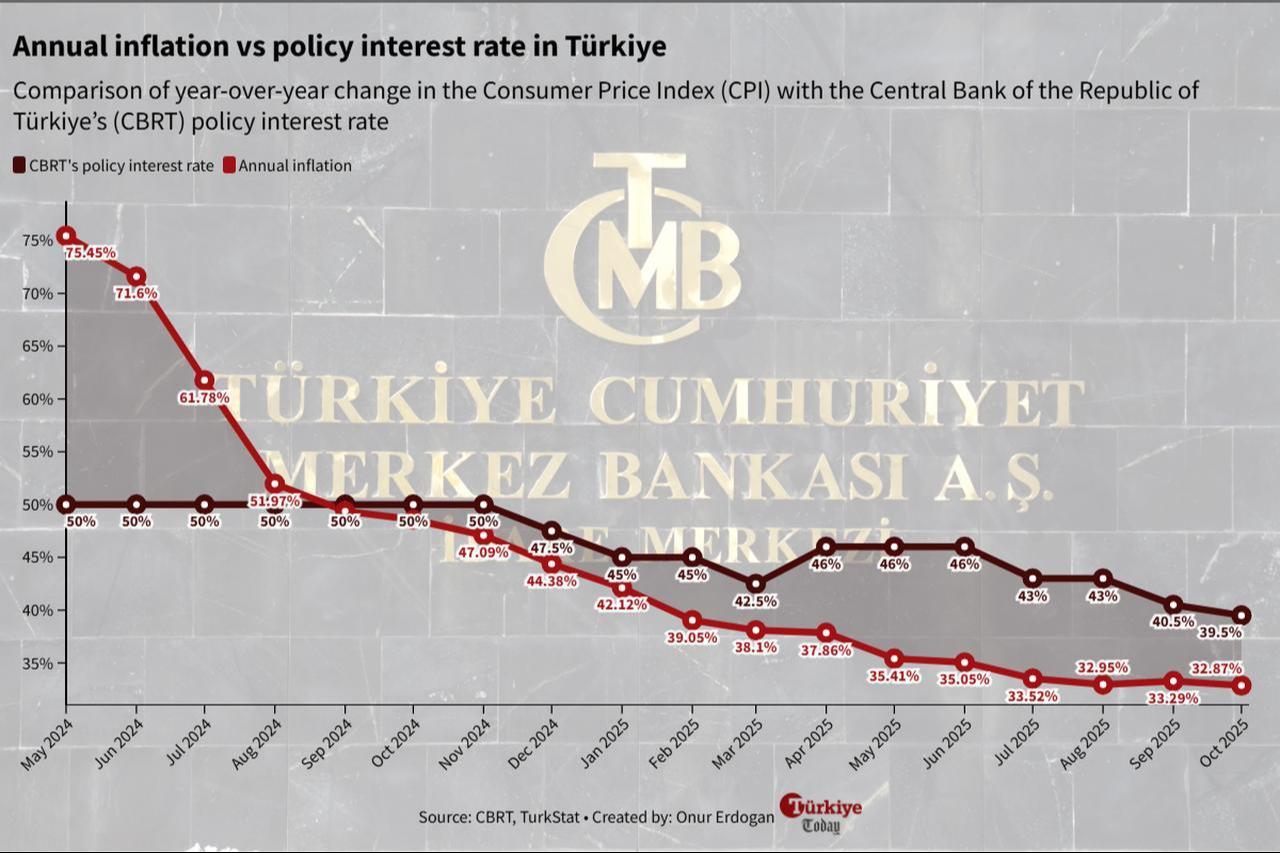

Turkish policymakers began the easing cycle in July with a 300-basis-point cut, but slowed the pace to 100 basis points in October due to weaker-than-expected disinflation, leaving the policy rate at 39.5%.

Morgan Stanley’s anticipation aligns with the expectations of market participants surveyed by the central bank in November, who projected at least a 100-basis-point cut at the December meeting.

The report also projected Türkiye’s year-end inflation at 21% for 2026 and 17% for 2027, exceeding both the Turkish government’s Medium-Term Program and the CBRT’s latest inflation report. The bank attributed the slower disinflation in 2027 to an expected pickup in economic growth, though it saw the overall trend of declining inflation to continue.

Official data showed that Türkiye’s headline inflation fell to 32.87% in October, after briefly rising in September and interrupting a 15-month downtrend.

In a separate note, France-based bank Societe Generale strategists predicted that the performance of emerging market currencies may deteriorate in 2026 due to a strengthening U.S. dollar, bracing for average spot returns of just 0.3% and total returns around 3% across emerging market currencies.

However, currencies of Nigeria, Türkiye, and Brazil are expected to outperform their peers, according to the note. Societe Generale views many emerging market currencies as currently overvalued, with some Central and Eastern European currencies considered 15–20% above fair value, and the Colombian and Mexican pesos overvalued by 10–15%.

The report added that local bond yields in emerging markets are likely to remain positive in 2026, with better performance expected in Türkiye and Brazil.