Turkish central bank governor Fatih Karahan signaled a cautious approach to future monetary policy Wednesday, stressing that decisions will be guided by the inflation outlook and assessed at each meeting.

"The size of the steps will be reviewed with a cautious, meeting-by-meeting approach focused on the inflation outlook," Karahan said during a presentation at the Ankara Chamber of Industry’s August assembly meeting.

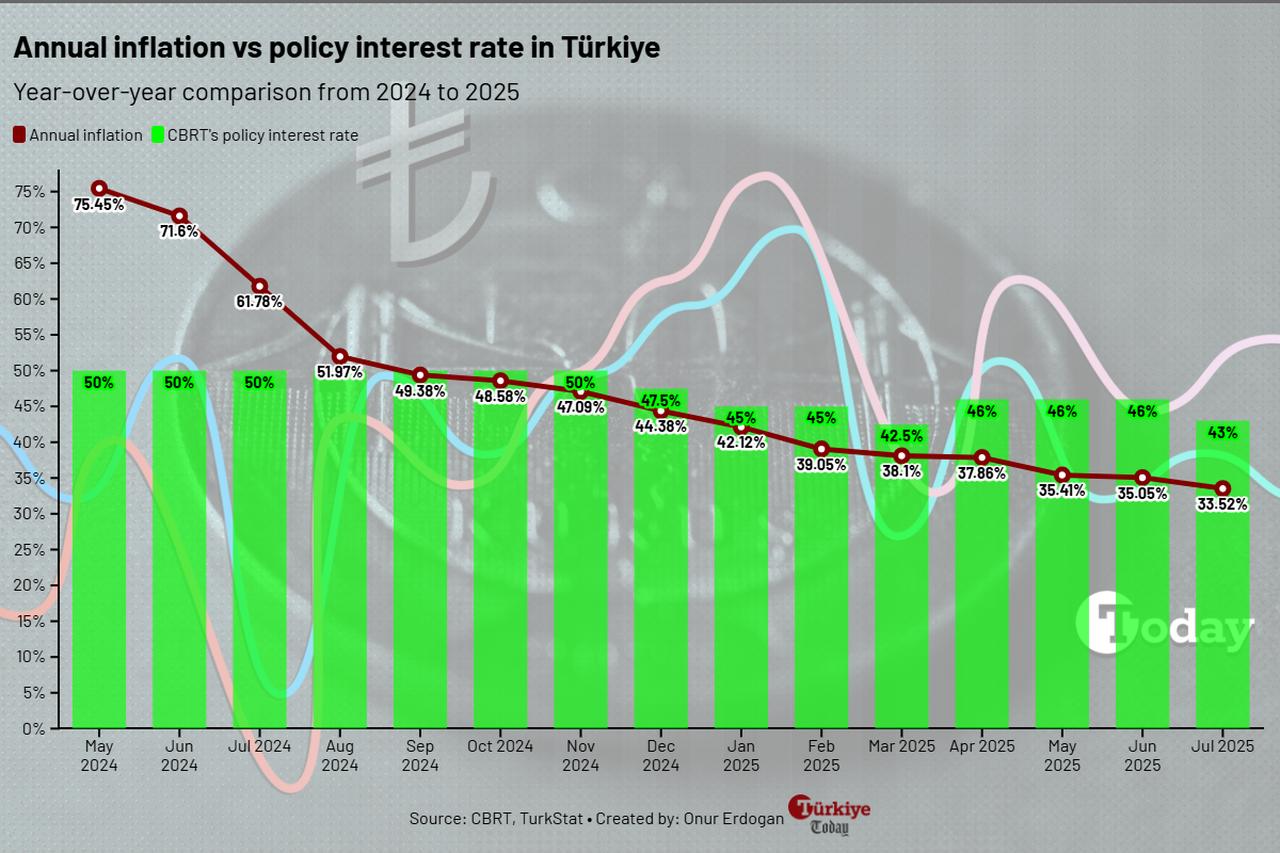

The Turkish central bank resumed interest rate cuts in July with a 300-basis-point reduction, bringing the policy rate down to 43%. According to the August Survey of Market Participants, also conducted by the central bank, markets anticipate another cut of the same size in September.

Karahan stressed that the disinflation process, which began in June 2024, is continuing uninterrupted. "We expect inflation to remain within our forecast range at the end of the year," he told business leaders.

He explained that balanced demand has helped reduce price pressures, even though monthly inflation temporarily rose to 2.06% in July. The annual inflation rate fell for the 13th consecutive month, declining to 33.5% from a peak of 75.5% in May 2024.

Since 2013, the Central Bank of the Republic of Türkiye (CBRT) has regularly met with firms across various sectors, Karahan said, noting that 310 companies in Ankara and nearby provinces were consulted in 2025 alone, with 2,630 meetings held over the past five years.

"We obtain timely and qualified information from the real sector. This provides input for our decisions and helps us identify both cyclical developments and structural challenges," he said.

Karahan underlined that inflation expectations have begun to decline. "As of August, the 12-month ahead inflation expectation stands at 54.1% for households, 22.8% for market participants, and 37.7% for the real sector," he noted.

He added that while rents and education costs continue to push up service inflation, the overall downward trend is now more widespread.

On credit and corporate debt, Karahan underscored, "The share of companies requesting concordat is relatively small," pointing to limited systemic risk. He emphasized that borrowing costs are closely tied to inflation, saying, "Rate cuts can only be effective when inflation is under control."

The governor highlighted the steep fall in balances held under the government’s foreign exchange-protected deposit scheme, known as KKM, which is also set to be phased out by year-end.

"The balance fell from $143 billion in August 2023 to $11 billion by August 2025, a decrease of $132 billion," Karahan said.

During the same period, the share of Turkish lira deposits rose to 60.4%, supported by the central bank’s tight policy stance, which kept the policy rate above 40% since November 2023.

Karahan concluded by reiterating the CBRT’s determination to maintain its stance until lasting price stability is secured. "The tight monetary policy stance will continue until price stability is achieved," he said.

"If there is a clear and permanent deterioration in the inflation outlook, all monetary policy tools will be used effectively," he added.