This article was originally written for Türkiye Today’s weekly economy newsletter, Turkish Economy in Brief, in its Jan. 5 issue. Please make sure you are subscribed to the newsletter by clicking here.

The year has begun on a positive note for Turkish markets. Inflation for 2025, announced today, came in at ...%. This marks a drop of over 13 percentage points from the 44.38% level recorded at the end of 2024.

The year 2025 closed as one marked by continued disinflation, and the expectation for 2026 is that “the decline in inflation will persist.” There have been key developments in this regard. The increase rate for taxes and fees in 2026 was initially announced as 25.49%, but it was instead implemented at 18.95%.

Price hikes introduced at the start of the year tend to push January and February inflation higher. However, keeping these increases aligned with “expected inflation” levels in 2026 could help produce more moderate inflation figures in the first two months. If the downtrend in annual inflation continues, this could create a supportive environment for the Central Bank to proceed with interest rate cuts.

Let’s also recall that Türkiye’s central bank (CBRT) reduced its policy rate to 38% by the end of 2025. Following this week’s inflation data release, markets are preparing for a busy agenda in the second half of January.

The Central Bank’s first Monetary Policy Committee (MPC) meeting of 2026 is scheduled for January 22. Given the temporary effects of new year price hikes, expectations are rising that the CBRT may wait for January and February inflation figures before deciding on further moves.

The last rate cut came in December, with a 150 basis-point reduction. Currently, there remains a roughly 7-point gap between the policy rate and annual inflation, suggesting tight monetary policy is still in place.

Credit rating agencies are also set to release their first assessments of Türkiye in January.

Fitch Ratings will issue its first 2026 review on January 23. In its last decision on July 26, 2025, Fitch maintained Türkiye’s credit rating at “BB-” with a “stable” outlook.

On the same day, another agency, Moody’s, is also expected to publish its assessment. Moody’s last review on July 25, 2025, upgraded Türkiye’s rating from “B1” to “Ba3,” while also keeping the outlook at “stable.”

A separate note is warranted on Türkiye’s credit default swap (CDS), a measure of the country’s default risk. Last week, Türkiye’s CDS dropped to 204, the lowest level in seven years. For comparison, CDS levels stand at around 137 in Brazil, 134 in South Africa, 90 in Mexico, 87 in India, and 68 in Indonesia. Türkiye is clearly moving closer to peer economies in terms of perceived risk.

A decline in CDS signals improved “economic health” and “financial stability.” Lower risk premiums also help increase foreign investors’ appetite for exposure to that country.

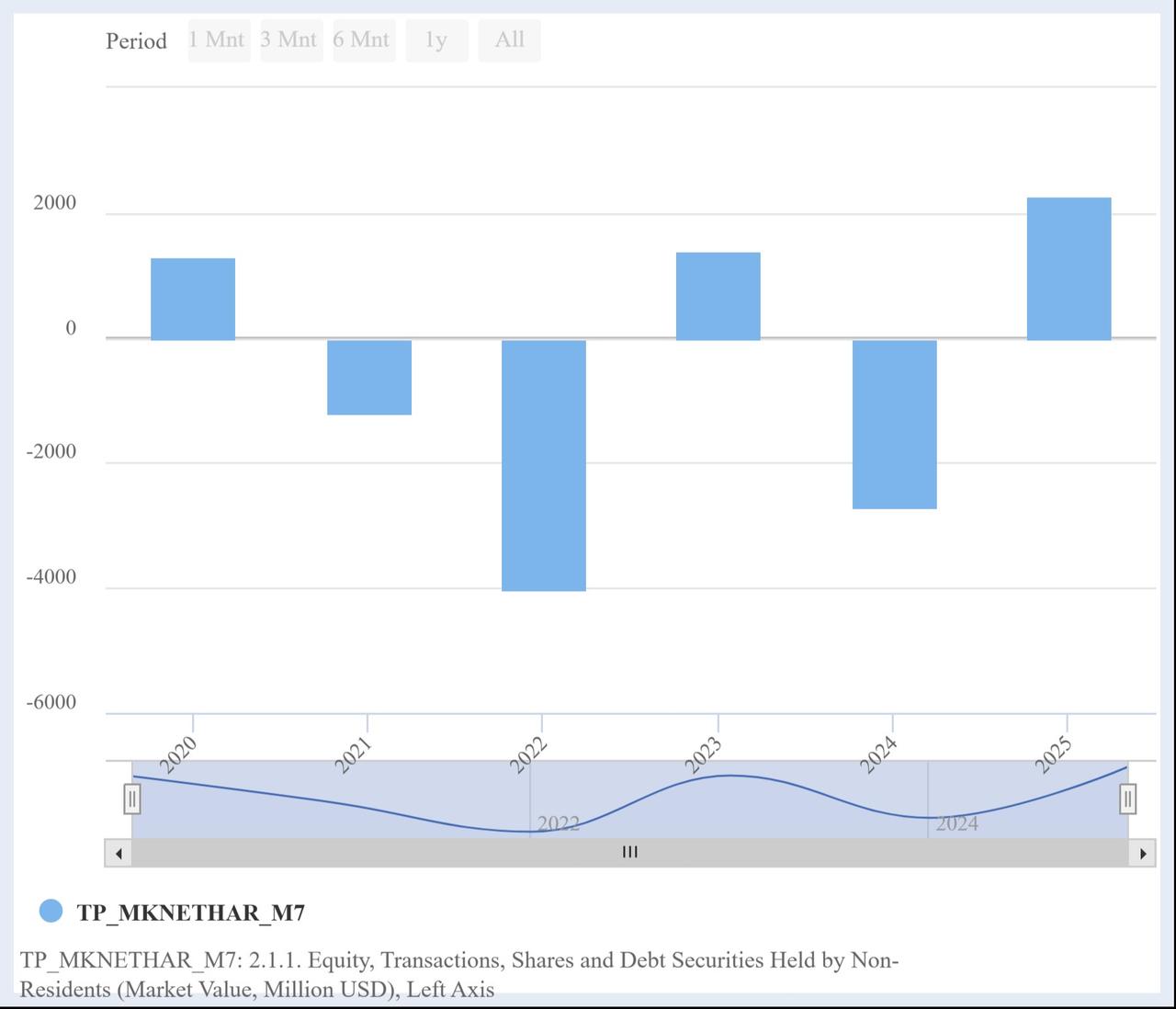

In fact, foreign investors became net buyers on Borsa Istanbul in 2025, with net purchases totaling around $2.2 billion.

The Borsa Istanbul BIST 100 index closed the first trading day of 2026 with a strong 2.10% gain at 11,498 points, the sharpest daily increase since October 24. Weekly performance also reached a high, bringing the index close to its 11,605 peak. The banking index (XBANK) outperformed the overall market last week with a 6.40% gain — a move likely supported by the fall in Türkiye’s CDS.

In 2026 strategy reports, financial institutions are also offering price targets for the BIST 100. Local brokerage Tacirler Yatirim forecasts 15,200 over a 12-month horizon, while Gedik Yatirim projects 16,069.

In short, 2026 begins with “more optimistic expectations” for Türkiye.