This article was originally written for Türkiye Today’s weekly economy newsletter, Turkish Economy in Brief, in its September 22 issue. Please make sure you are subscribed to the newsletter by clicking here.

The Turkish market continues its economic story—characterized mainly by "falling inflation, declining interest rates, and balanced growth"—successfully, despite occasional turbulence, supported by rational policies. On this path, Türkiye’s credit default swaps (CDS) have also seen remarkable declines.

CDS, a very important indicator in financial markets, can be defined as a measure of a country’s default risk. It is the premium paid against "the risk of failing to fulfill credit obligations" when borrowing from external markets. A high CDS value also indicates high credit risk, leading a country to borrow at a higher cost. CDS is seen as a barometer of risk perception and is an important metric for financial decision-making. Foreign investors also take CDS into account when deciding to invest in a country.

A decline in credit risk premiums, on the other hand, signals economic stability and strong fiscal discipline. A lower risk premium increases foreign investors’ confidence and inflows into the country. It reduces borrowing costs and supports economic growth, creating a generally positive sentiment in the markets.

Such an important indicator fell to 237 basis points for Türkiye last week. This rate also marked the lowest level recorded since February 2018. In other words, Türkiye’s credit risk premium hit its lowest in nearly 7.5 years.

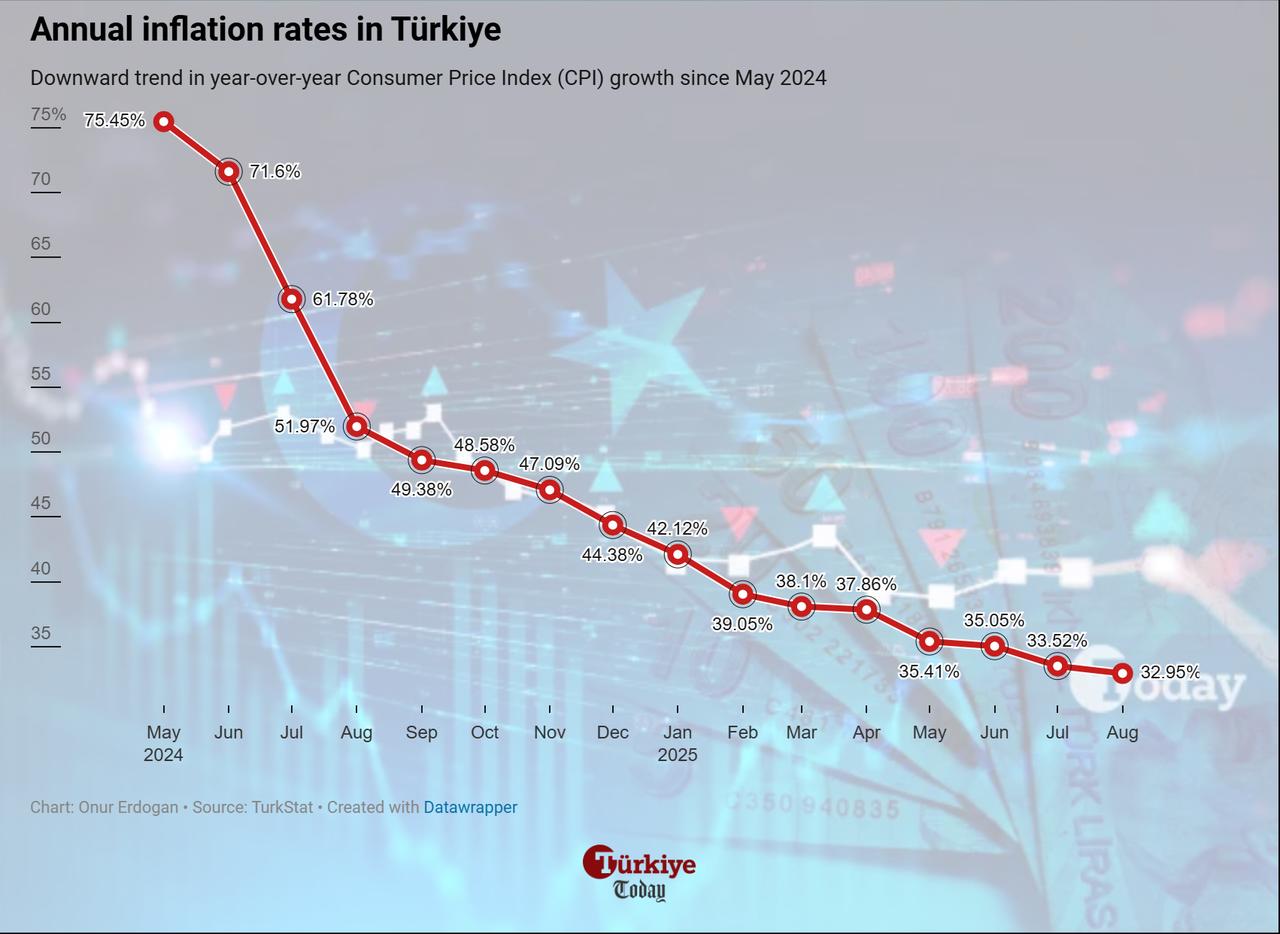

Looking at the recent macroeconomic picture:

In recent weeks, "political uncertainty" linked to the main opposition CHP has also seen developments. The lawsuit filed for the annulment of the November 2023 congress was once postponed "without injunction," while the Supreme Election Council approved a new extraordinary congress, reducing uncertainty and supporting the decline in country risk.

On the global front, the U.S. Federal Reserve last week cut interest rates for the first time this year, lowering its policy rate to 4.25%. Its signals of potential further cuts in October and December weakened the U.S. dollar globally. Lower rate expectations for the reserve currency also keep alive the outlook for increased foreign capital inflows into emerging markets, including Türkiye.

According to the latest CBRT data, foreign investors purchased $587.9 million worth of Turkish bonds in just the previous week. Considering that the Borsa Istanbul index jumped by 8.89% last week, it is highly likely that foreign capital inflows were even larger.

Finally, looking at CDS levels of peer countries: Brazil at 125, Indonesia at 71, Mexico at 85, and South Africa at around 146. These figures show that Türkiye also has "room to move toward lower CDS levels."