Inflation in Türkiye is gradually easing, but further tightening in fiscal and monetary policies remains necessary to ensure lasting price stability, the International Monetary Fund (IMF) said on Saturday.

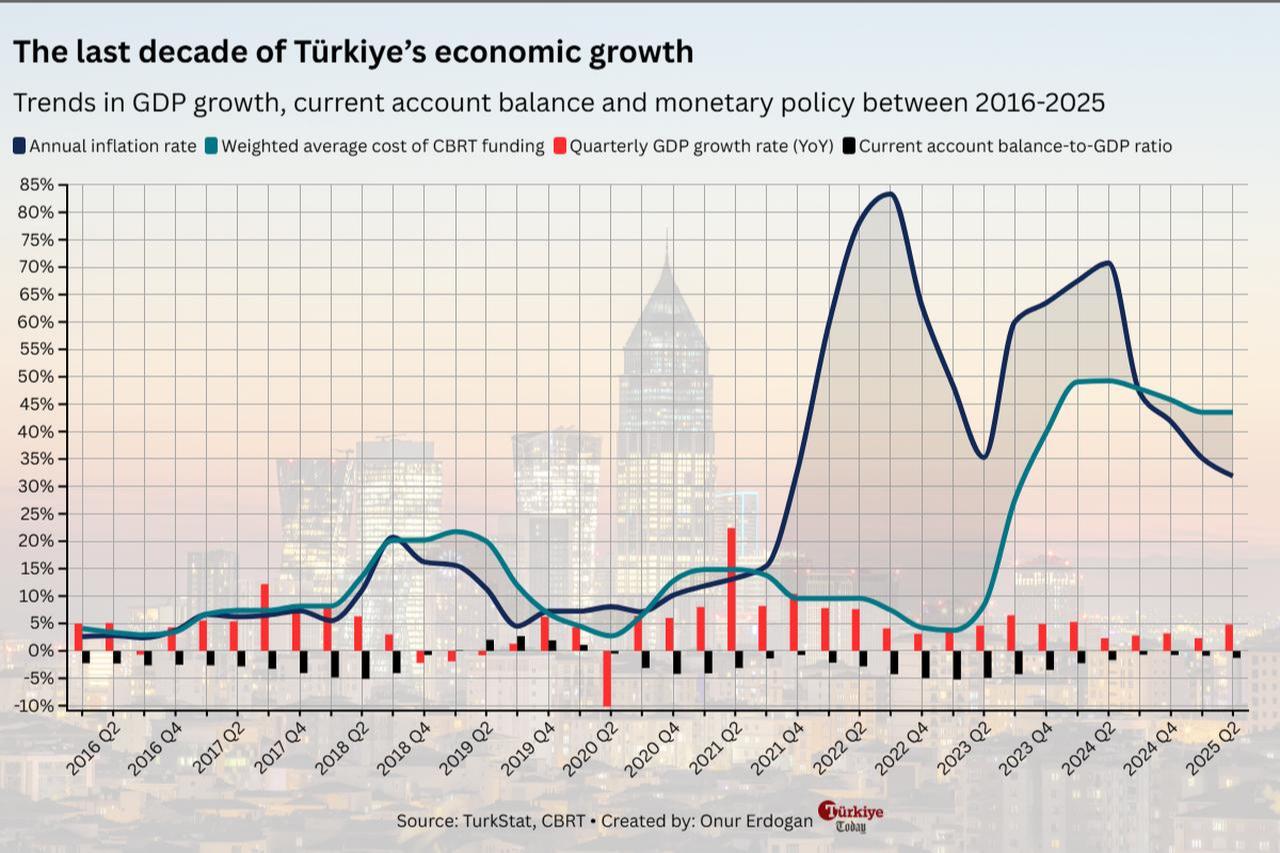

The assessment comes from the Fund’s latest staff report, issued under Article IV consultations following a recent mission to Türkiye, which projects inflation to decline to 33% by the end of 2025, down from nearly 50% in late 2024 and in line with the Turkish central bank’s projection range, but warns that elevated price pressures and strong domestic demand continue to pose risks.

Türkiye's inflation resumed its decline in October, falling to 32.89%, while policymakers delivered a third consecutive rate cut, albeit at a slower pace, bringing the policy rate down to 39.5%, below 40% for the first time since late 2023.

Another rate cut is expected at the year's final Monetary Policy Committee (MPC) meeting in December, with at least 100 basis points anticipated by Turkish market participants.

The fund urged Türkiye to maintain a firm disinflation trajectory by raising real policy rates, postponing interest rate cuts, and clearly communicating the triggers for policy shifts.

Inflation above the Central Bank of the Republic of Türkiye’s (CBRT) 24% target undermines market efficiency, deepens income inequality, and risks fueling reform fatigue if not addressed promptly, the IMF's report said.

While recent reforms have helped restore investor confidence and boost reserves, the fund emphasized that sustained policy discipline is essential to anchor expectations and safeguard growth.

The IMF praised Türkiye’s fiscal consolidation in 2025, projecting the budget deficit to decline from 4.7% of gross domestic product (GDP) in 2024 to 3.6% this year. For 2026, the Fund anticipates a slight widening of the deficit to 3.7% of GDP, slightly higher than the official target, assuming only limited further tightening.

To reduce inflationary pressure and rebuild buffers, the Fund recommended additional revenue measures, including simplifying Türkiye’s value-added tax (VAT) structure and scaling back corporate tax incentives.

It also emphasized phasing out energy subsidies while safeguarding low-income households.

In the medium term, with lower inflation and interest payments, Türkiye could free up around 1% of GDP in fiscal space to expand social support, including targeted cash transfers and incentives for labor force participation.

The Fund credited Türkiye’s flexible monetary policy framework for maintaining market stability amid volatility. The CBRT’s use of policy rates, credit growth ceilings, and foreign exchange interventions helped contain inflationary shocks without jeopardizing financial stability, the report said.

The IMF highlighted the CBRT’s recent communication improvements and distinction between inflation forecasts and targets as positive developments. It also called for reforms to enhance central bank independence, remove conflicting signals from quantitative tools, and gradually allow more flexibility in the exchange rate as inflation expectations stabilize.

On the financial front, the banking sector remains sound, supported by adequate capital and liquidity buffers. Foreign exchange-protected deposits, known locally as KKMs, which had posed a significant burden and vulnerability, have been successfully phased out. Non-performing loans are also appropriately provisioned, according to the Fund.

The IMF noted that Türkiye’s GDP growth, estimated at 3.7% in 2026, remains below its pre-global financial crisis trend. To restore higher potential growth, the report called for structural reforms that enhance productivity and reduce external vulnerabilities.

Key proposals include aligning tertiary education incentives with labor market needs, expanding vocational training, improving the rule of law, strengthening anti-corruption efforts, and improving support mechanisms for small- and medium-sized enterprises (SMEs).